Join thousands of investors trading daily with the most secure and reliable global broker today.

Perfect plan to get started

Perfect plan for professionals!

Perfect plan to get started

Up to 1:500

From 1.4 pips (Zero Commission)

24/7 Multilingual Support

Available

Included

Standard

—

—

Perfect plan for professionals!

$5000/Minimum Deposit

Up to 1:500

From 1.4 pips (Zero Commission)

24/7 Multilingual Support + Dedicated Relationship Manager

Available

Included

Tier 1 Liquidity – no dealing desk, no slippage

Daily Signals & Market Analysis by Acuity (FCA Regulated)

MAM/Copy Trading Available

Deposit and withdraw with ease using your preferred payment method

Yes, trading is legal. While Trade247 is regulated by the UAE’s SCA, residents can trade through globally recognized platforms.

Anyone 18+ with valid ID and proof of residence can open an account, subject to jurisdictional restrictions and compliance checks.

Yes! Trade247 offers educational resources, demo accounts, and responsive customer support to assist beginners every step of the way.

Click 'Register' or 'Create Account' or 'Get Started' on our website and complete the short registration form. You’ll receive a confirmation email and be prompted to upload verification documents. Once approved, your account will be activated.

A government-issued ID (passport, national ID, or driver’s license) and a recent utility bill or bank statement (dated within the last 3 months) for proof of address.

Yes, you can open multiple accounts for different strategies. Reach out to support for multi-account setup.

Contact our support team through live chat or email. We’ll guide you through the secure closure process.

We accept bank transfers, credit/debit cards, and select e-wallets. Available methods vary by region.

Trade247 does not charge internal fees. However, third-party processors or banks may apply a charge.

Most withdrawals are processed within 1–3 business days, depending on the payment method and verification status.

Minimum deposit requirements vary by account type. Please refer to our Account Types page.

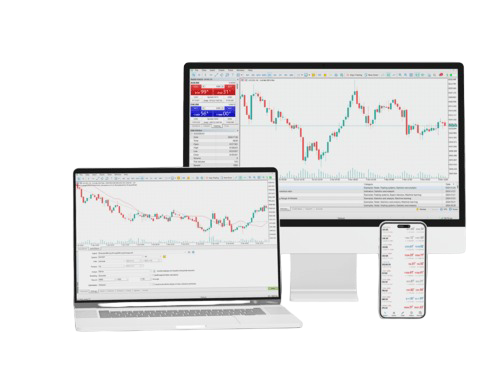

Trade247 provides access to MetaTrader 5 (MT5), one of the most powerful and versatile trading platforms in the world. We also offer a web-based trading platform optimized for both desktop and mobile users, ensuring seamless trading anytime, anywhere.

Trade247 does not charge internal fees. However, third-party processors or banks may apply a charge.

Most withdrawals are processed within 1–3 business days, depending on the payment method and verification status.

Minimum deposit requirements vary by account type. Please refer to our Account Types page.

A position is an open trade in the market. You can either go 'long' (buy) or 'short' (sell), and when you close the trade, your profit or loss is realized.

A pending order is an instruction to open a trade when the price reaches a specific level. It allows you to plan trades without needing to monitor the market constantly. Types include Buy Limit, Sell Limit, Buy Stop, and Sell Stop.

Leverage lets you control a larger position with a smaller amount of capital. For example, 1:100 leverage means you can trade $10,000 with just $100. While it can increase profits, it also increases risk—use it responsibly.

The spread is the difference between the bid (sell) price and ask (buy) price of an asset. A tighter spread means lower trading costs.

Margin is the amount of money you need to open and maintain a leveraged position. If your account falls below the required margin, a margin call may be triggered, closing your trades.

Trade Forex, Commodities, Indices, Metals, Stocks, and Synthetic Indices—all through a single MT5-powered platform.

Forex and major markets operate Sunday evening to Friday night (GMT). Other instruments may vary. Synthetic Indices trade nearly around the clock.

Yes. If you keep positions open overnight, a swap fee may apply depending on the instrument and trade direction. For interest-free trading, Islamic accounts are available.

Yes. Islamic accounts comply with Shariah law by removing overnight interest charges. Available upon request after registration.

Absolutely. Our free demo account simulates live market conditions with virtual funds—ideal for testing strategies risk-free.

Trade247 operates under international regulatory standards. Please refer to our Legal or About page for updated licensing information.

Yes. We use advanced encryption, secure servers, and strict verification protocols to keep your data and funds safe.

All client funds are held in segregated accounts at top-tier banks to ensure safety and separation from company operating funds.